HOME LOAN RESCOUCES

The all-important credit score - know exactly where you stand.

Credit scores range anywhere from 350-850. The higher the better. Your number is determined by five factors combined to calculate your personal score. Even if your score is lower than desired, don’t give up. With a little clarity and focus, a lot can be done to make things better.

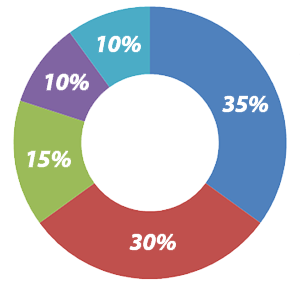

Types of Credit - 10%:

This looks at what types of credit you have.

New Credit - 10%:

New applications for credit might cause you to be risky and lower your score.

Length of History - 15%:

How long your accounts have been open. If you are going to close an account, DO NOT close the oldest.

Payment History - 35%:

Making sure that you have your payments in full and on time.

Debt Utilization - 30%:

How active EACH of your accounts are will affect this portion of your score.

Do's

- Immediately inform your Loan Officer if there are any changes in your employment, income, or assets.

- Continue living in your current residence.

- Continue making all mortgage or rent payments.

- Continue to make payments and stay current on all existing credit accounts.

- Be prepared with an explanation for any credit “blemishes” and recent credit inquiries.

- Research and select a preferred homeowner’s insurance provider.

Dont's

- Make any major purchases or home improvements.

(ie. auto, boat, appliances, furniture, pool) - Apply for new credit or loans.

- Pay off any charge-off accounts, collections, loans, credit cards, or consolidate debt.

- Close any credit card accounts, max-out, or over-charge credit accounts.

- Change bank accounts of transfer balances from one account to another.

- Change the source of your “closing funds.”

- Deposit large amounts of cash into your own bank account without proper documentation.

A little preparation in advance, will keep you moving quickly all the way home.

Get ready. Get set. Go, go, go!

Items that may be requested during your home loan process:

- Valid photo identification

- Bank/asset statements for the last two months on all checking, savings, stock, mutual funds, IRA, or other liquid assets you would like on your loan application

- Pay stubs for the last 30 days

- W-2 forms for the past two years

- Federal tax returns for the past two years, including all schedules

- If self-employed or you own more than 25% of a business, copies of business tax returns for the past two years, including all schedules. Provide all K-1’s to prove ownership interest in any entity.

- For other real estate owned, we need loan information, monthly payment, and any rent collected

- Home owners insurance contact info

- Landlord/mortgage company information for past two years

- Certificate of Eligibility and DD-214 or Statement of Service, if applying for a VA loan

- Bankruptcy or property short-sale/foreclosure information

- A copy of the settlement statement if you sold property in the last three months

- Child support payment info, copy of divorce decree and/or separation agreement, if applicable

- A copy of the signed real estate contract, if you’ve already made an offer on a home

- Resident alien card, front and back, if applicable

For Refinancing your home, some additional information may be needed:

- Current mortgage statement for property you want to refinance

- Current second mortgage or equity line statement for property you want to refinance

- Estimated value of your home

- Recent annual Homeowners insurance policy statement for the property you want to refinance